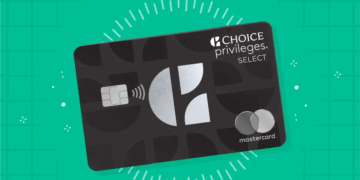

Apply for Choice Privileges Select Mastercard Credit Card Step-by-Step Guide

The Choice Privileges Select Mastercard offers generous reward points, substantial bonus points for new cardholders, and no foreign transaction fees, making it perfect for travelers. It also provides elite status perks and potential annual fee waivers, creating savings and exclusive benefits for frequent Choice Hotels guests.

How to Apply for the Emirates Skywards Premium World Elite Mastercard Credit Card

The Emirates Skywards Premium World Elite Mastercard offers valuable benefits such as earning Skywards Miles on purchases, complimentary global lounge access, luxury travel perks, comprehensive travel insurance, and exclusive event access. Enhance your travel experience with hotel upgrades and peace of mind through robust insurance coverage.

How to Apply for Delta SkyMiles Platinum American Express Credit Card

Unlock travel rewards with the Delta SkyMiles Platinum Card: Earn up to 3 miles per dollar, enjoy perks like a free checked bag, priority boarding, and an annual companion ticket. Plus, receive fee credits for Global Entry or TSA Pre✓ and exclusive access to entertainment events.

How to Apply for the M1 Owners Rewards Credit Card A Step-by-Step Guide

The M1 Owner's Rewards Credit Card offers cash back on purchases, low annual fees, and integrates with M1 Finance for investment opportunities. It also provides financial management tools to optimize spending and savings, making it a strong choice for those looking to enhance their financial health.

The Role of Artificial Intelligence Technologies in Financial Market Updates

Artificial intelligence technologies are revolutionizing financial market updates by enhancing data analysis, predictive modeling, and risk management. They empower investors to make informed decisions quickly while raising ethical considerations around algorithmic bias and accountability. Emphasizing transparency ensures AI's effectiveness in navigating the evolving financial landscape.

The Impact of Interest Rates on Stock Market Updates

Interest rates significantly influence stock market dynamics, affecting corporate borrowing, consumer spending, and investment behavior. Rising rates can lead to decreased stock values and market volatility, while lower rates typically boost market confidence and stock prices. Understanding these interactions is essential for effective investment strategies amidst fluctuating economic conditions.

Emerging Trends in Cryptocurrencies: What to Expect in 2024

As 2024 unfolds, cryptocurrencies are evolving with trends like decentralized finance (DeFi), central bank digital currencies (CBDCs), and green cryptocurrencies gaining traction. Increased regulation and enhanced security measures are also on the rise, reshaping investment strategies and fostering mainstream adoption within the dynamic digital finance landscape.

How Government Policies Are Shaping Market Updates in 2023

In 2023, government policies significantly shape market updates, influencing investor sentiment and economic performance. Key factors include monetary policy adjustments, fiscal stimulus packages, regulatory changes, and external influences like global trade and geopolitical tensions. Understanding these dynamics is essential for strategic investing in an evolving financial landscape.

Analysis of Real Estate Market Updates and Their Economic Implications

This analysis explores recent real estate market updates, highlighting key trends such as interest rates, employment levels, and regional differences. Understanding these dynamics is vital for buyers and investors, as they reflect broader economic implications and help navigate market decisions effectively. Stay informed to capitalize on opportunities.

How to Create a Diversified Investment Portfolio for Beginners

Discover essential strategies for building a diversified investment portfolio as a beginner. Learn about different asset classes, assess your investment goals, and understand risk tolerance. Emphasizing diversification helps mitigate risks while maximizing returns, setting a solid foundation for long-term financial growth and stability in your investment journey.